How to Conduct a Social Media Audience Analysis and Effectively Use the Insights

Learn how to do an effective social media audience analysis to discover insights that lead to increased engagement and brand loyalty.

In the world of social media, the audience analysis is my one true compass.

Knowing my audience — their habits, interests, profiles, and motivations — helps me create messages that cut through the noise.

The audience research is what moves marketing from guesswork to strategy, allowing me to speak directly to the people who matter most.

In this article, I’ll guide you through my core steps for a thorough social media audience analysis, from segmenting my audience to turning data into actionable insights. I’ll also share expert tips from Mya Shell, an industry leader in digital strategy, whose advice has helped me elevate my own audience research. Let's get right into it!

Key takeaways

-

What does a social media audience analysis imply?

Social media audience analysis implies understanding who your audience is, what drives their behavior, and how to create content that resonates with their real needs. -

How to build your audience analysis framework?

To build your audience analysis framework, set clear goals, use a 4-dimensional model, and gather data from the right mix of analytics and research tools. -

How to run an effective audience analysis?

To run an effective audience analysis, follow a structured step-by-step process that includes demographics, psychographics, behaviors, competitive insights, and segmentation. -

What are the essential tools for a successful social media audience analysis?

Essential tools for a successful social media audience analysis combine native analytics, third-party platforms, social listening, surveys, and community monitoring. -

How to turn the insights of your social media audience analysis into an actionable strategy?

Turning insights into an actionable strategy means using audience data to shape content choices, engagement tactics, and community-building efforts that directly reflect what people want.

What does a social media audience analysis imply?

Social media audience analysis is the process of gathering and interpreting data about the people who engage with your brand. It helps you understand who your audience is, what drives their behavior, how they interact with your posts, and what they truly need from you. With these insights, you can create content that resonates, delivers real value, and supports your strategy.

I like to think of audience analysis as looking through both a microscope and a telescope. I zoom in to study the details of my digital community, then zoom out to see the broader patterns.

Although follower count matters, social media audience analysis is deeper than surface-level metrics. The real goal is to uncover the people behind each engagement — their motivations, habits, and expectations — so you can build content that genuinely works.

How to build your audience analysis framework?

Social media audience analysis is an ongoing endeavour: you don’t just research it once and let it slide.

To ensure my data is cohesive over time, I start by setting an audience analysis framework:

Set clear objectives

I don’t dive into an audience analysis without setting goals first. Clear objectives tell me what to look for and what to ignore.

Are we growing engagement, lifting conversions, or entering a new market? The goal shapes both the approach and the metrics.

Goals I set often include:

- Find high-value segments for targeted campaigns. Some audience segments can bring more ROI or convert faster. What sets them apart? How can I appeal to them more?

- Measure content resonance. Refining brand messages is an ongoing work, and the audience is guiding my hand. What do people want to hear about the product? Which pains do we solve? What formats win?

- Track behavior shifts. Audience evolves, and content consumption habits change over time. Can we spot new patterns early and respond fast?

Use the 4-dimensional audience analysis model

To fully analyze the social media audience of a brand, I always approach it from four different angles:

- Demographics. Age, gender, location, language, device. This is the baseline that tells me the foundational aspects of who my audience is, so I don’t target blindly.

- Psychographics. Values, interests, attitudes, lifestyle. This dimension helps me move from guesses about why something resonated or flopped towards real motivation.

- Behaviors. Metrics like saves, shares, watch time, and most active timing tell me how people interact with the content.

- Needs. The most important thing is analyzing the pain points and unmet needs. What do people miss from my content? I pull it from comment threads, survey feedback, and social listening data.

By mapping these four dimensions, I get a holistic overview of who my audience is, and that data can support both tactical planning and long-term community growth.

Assemble the right tools and data sources

Doing the social media audience analysis purely manually is time-consuming. My framework relies on picking the right mix of tools and data sources to keep it well-rounded and easy to maintain.

Usually, for a thought-through, deep analysis, I use:

- Native analytics tools from platforms (think Instagram Insights or Twitter Analytics) for basic metrics.

- Third-party analytics tools like Socialinsider for deeper insights and competitor analysis.

- Qualitative research methods like surveys, interviews, and social listening for a more direct connection.

This combination of data streams helps me gather both quantitative metrics and qualitative insights to determine the direction for my strategy.

How to run an effective audience analysis?

Once you’ve built your framework, it’s time to dive into data.

I held a social media audience analysis for our Socialinsider Instagram account. I’ll use it below, as an example to show you how to use a practical 7-step guide to a solid social media audience analysis:

Step 1: Define your audience analysis goals and success metrics

Just like we covered earlier, goals shape everything.

If I’m refining messaging, for example, I focus on content themes, sentiment, and whatever sparks the strongest reactions. My go-to metrics here are engagement rate, likes, comments, saves, shares, and my best-performing content pillars.

Depending on the objective, the list of questions I need answered shifts slightly, but the top-level ones tend to stay the same:

- Who is my audience?

- What do they care about and do on the platform?

- How do they react to my content?

- How does this compare to my competitors?

Step 2: Start gathering demographics data

Demographics are your baseline. Before you dive into behavior and motivations, you need a clear picture of who is on the other side of the screen.

When I analyze demographics, I focus on three core areas:

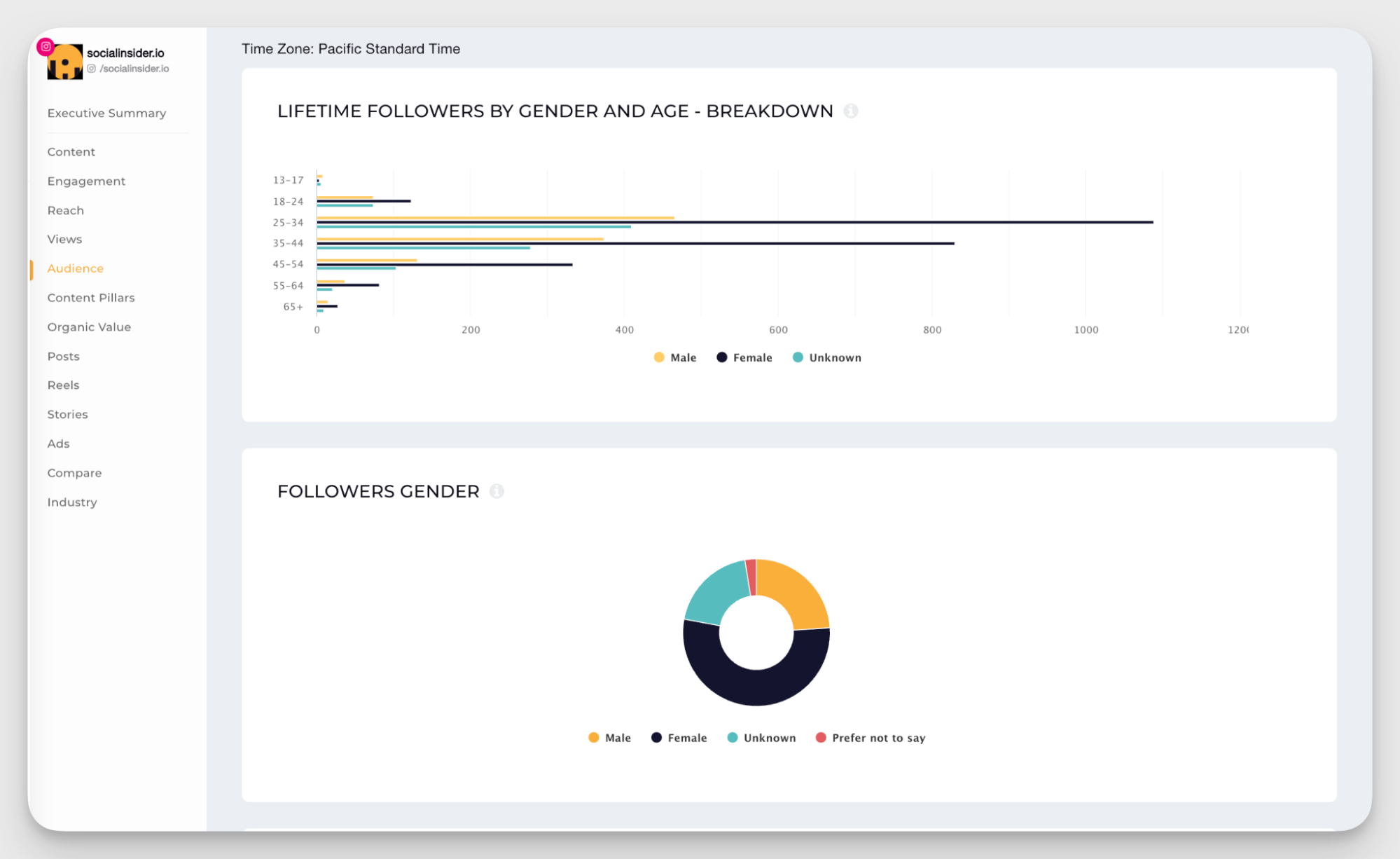

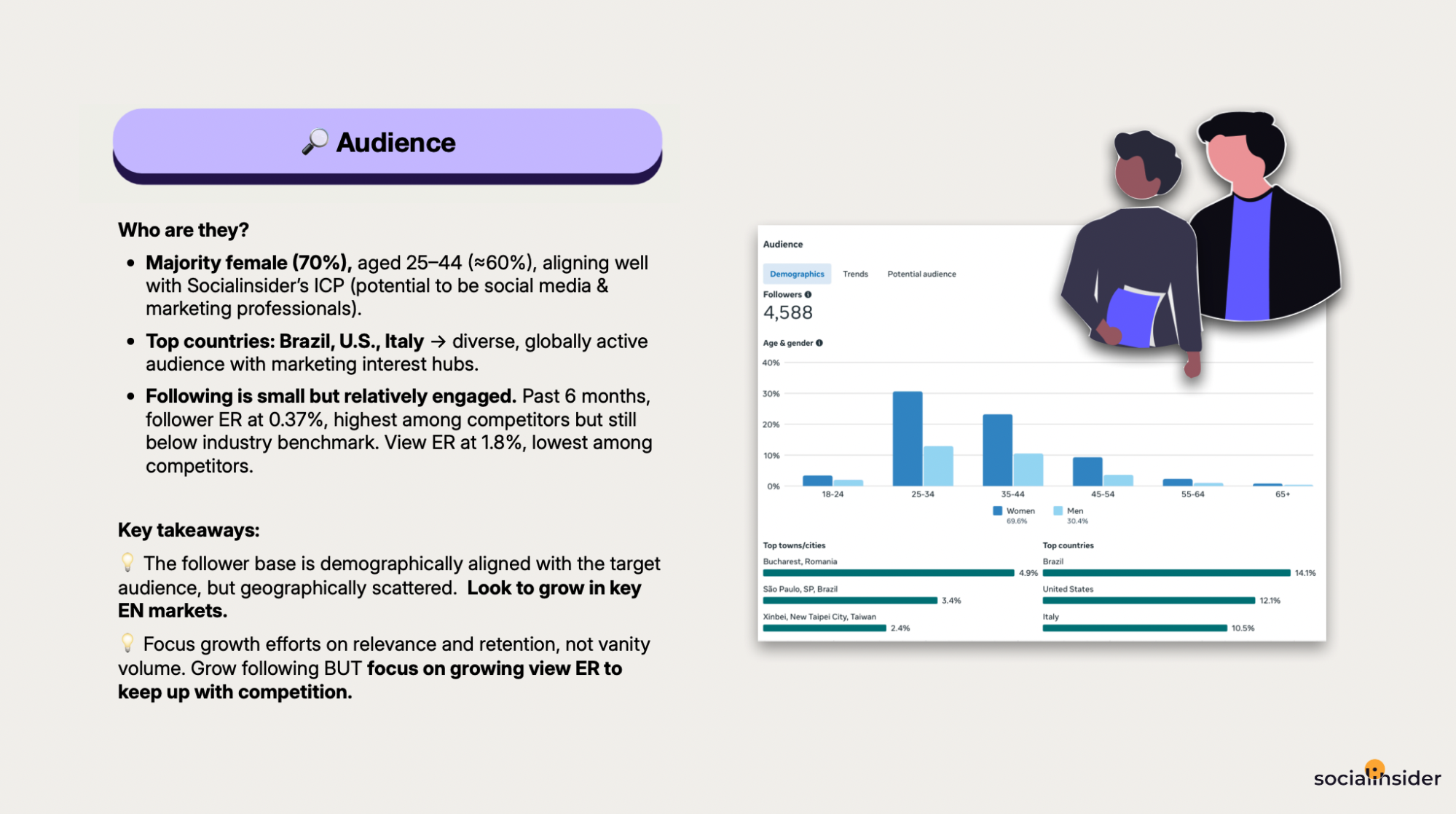

- Age and gender distribution. This gives me clues about potential pain points, the tone that might land best, and the kind of messaging that feels natural to this group. Here’s what it looks like for Socialinsider’s Instagram:

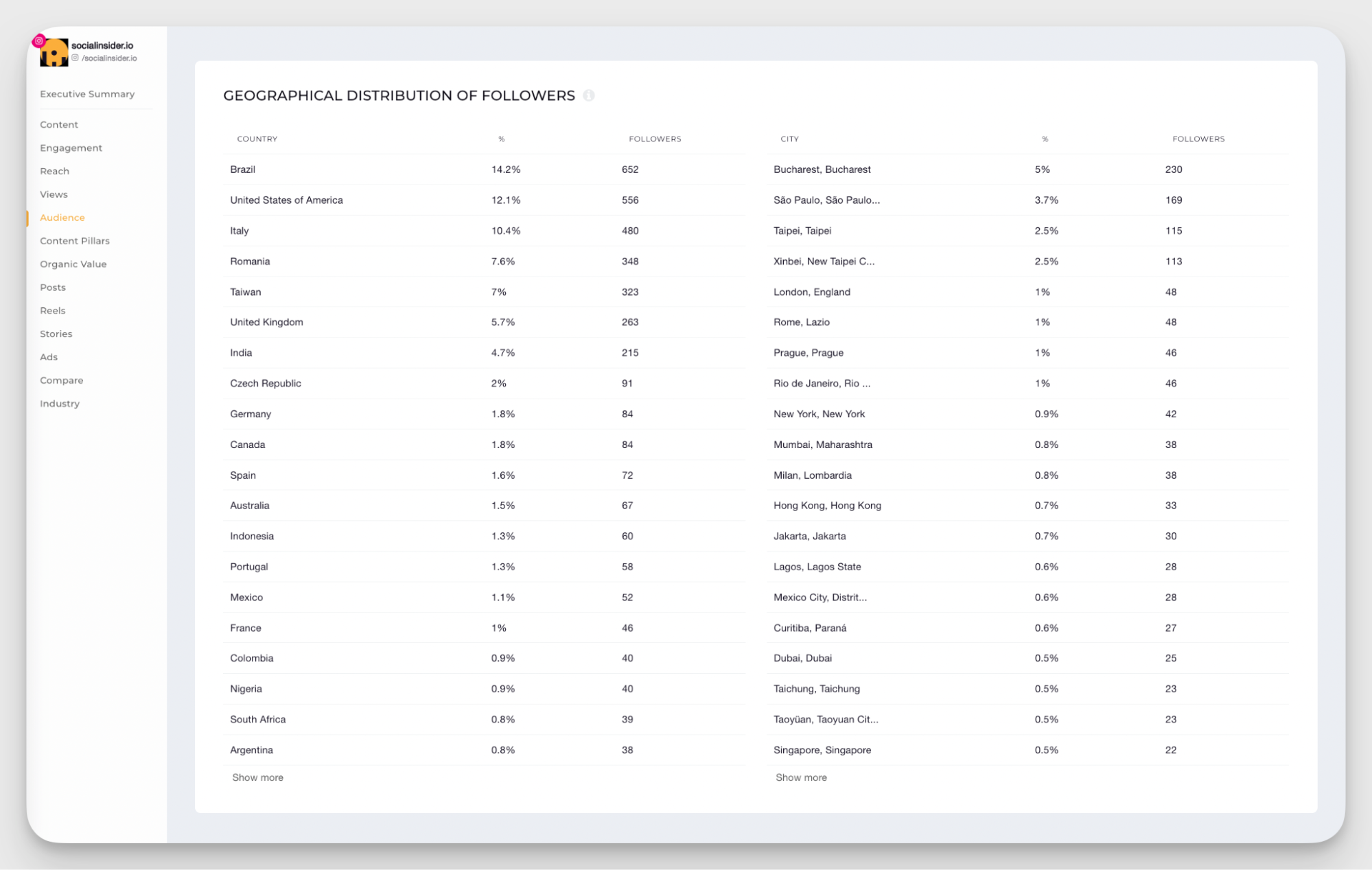

- Geographic location and language. This shapes posting times, cultural context (think local holidays or trends), and preferred language of communication. If you’re a local business with a mostly local audience, English may not be the smartest default. For Socialinsider’s global SaaS audience, English still makes the most sense, though:

- Device usage and platform preferences. This helps me decide on content ratios (horizontal vs. vertical), creative formats, and how to adapt visuals for the way people consume content.

So, eventually, here’s what we’ve got for Socialinsider’s audience demographic:

We gathered the demographic data and compared it to our ideal target audience. This snapshot already gave us enough context to understand who the current audience is. This also allowed us to draw some initial takeaways — like the fact that we should look to grow in EN markets.

Step 3: Analyze audience psychographics and interests

Psychographics describe why your audience behaves the way they do — their values, interests, motivations, frustrations, and the deeper context behind their choices.

No dashboard will ever say “Post about X and conversions will skyrocket.” But when you combine psychographic signals with your data and experience, the direction becomes clear.

Here’s how I pull those insights together:

- Use social listening for psychographic clues. Social listening helps understand the topics people care about, the tone they use, and the problems they’re trying to solve. It also shows shifts in sentiment towards my product that can shape future content.

- Identify pain points and challenges. By analyzing comments, DMs, competitor communities, and feedback threads, I can spot recurring frustrations, blockers, and worries. Knowing these pain points helps choose the right angles and examples to make the audience think, “Yes, this is exactly what I need.”

- Create detailed audience personas from psychographic data. We can build simple personas grounded in real behaviors and needs. A persona helps narrow down voice, tone, content formats, and the kind of value the audience expects from the brand.

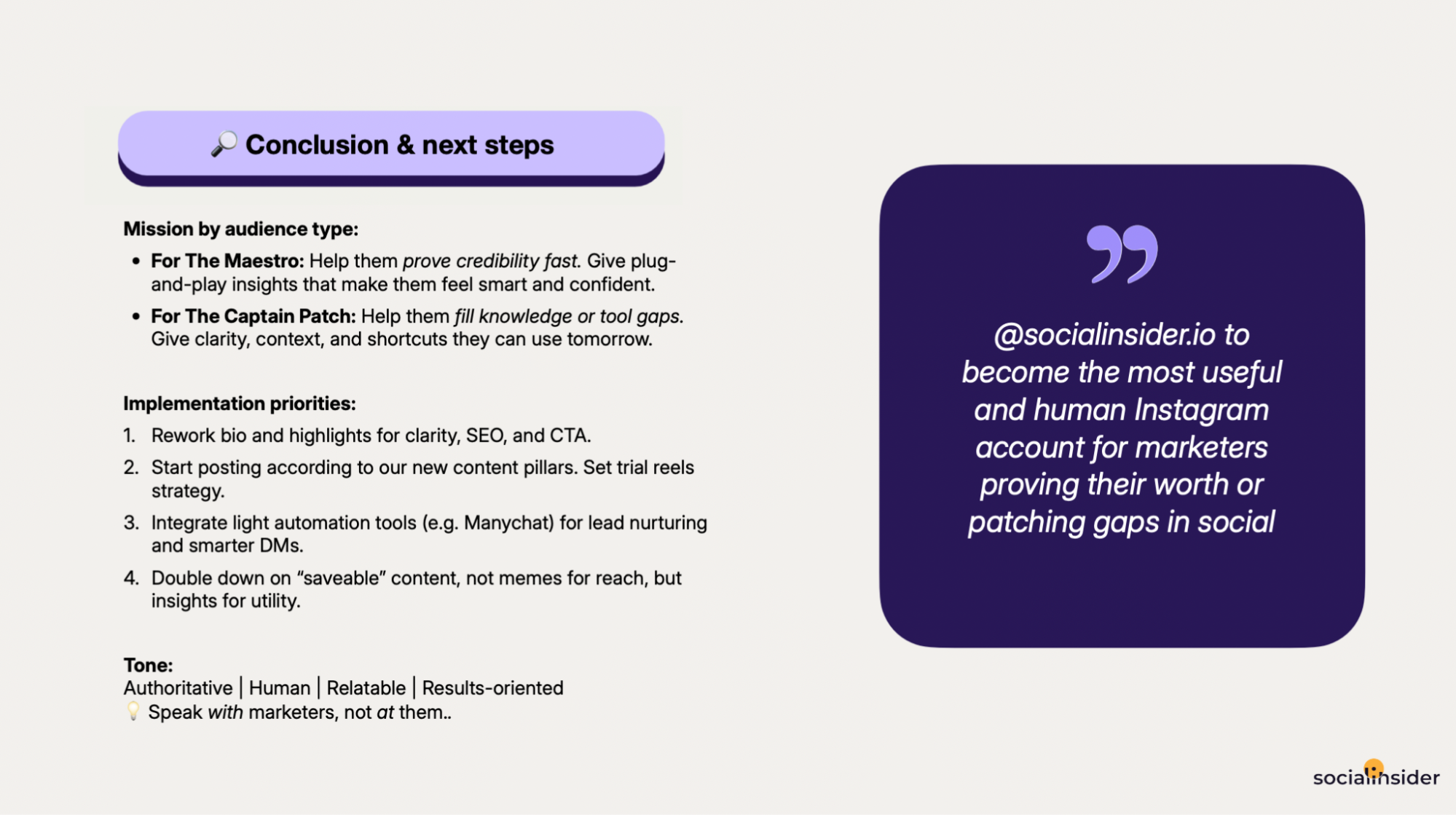

For Socialinsider, this psychographic layer pointed us toward a very specific direction: becoming the most useful and human Instagram account for marketers.

The pain points were clear: many marketers struggle to prove credibility fast, patch knowledge gaps, keep up with changing tools, and maintain authority.

With this in mind, we knew we needed content that offers clarity, shortcuts, and practical insights, paired with a tone that feels supportive, confident, and relatable.

Step 4: Dive into audience engagement and behaviour patterns

This step is about analyzing how my audience behaves and what drives their action. Engagement and consumption patterns show me crucial signals for shaping future content.

Content consumption behaviors

To understand how my audience consumes content, I analyze:

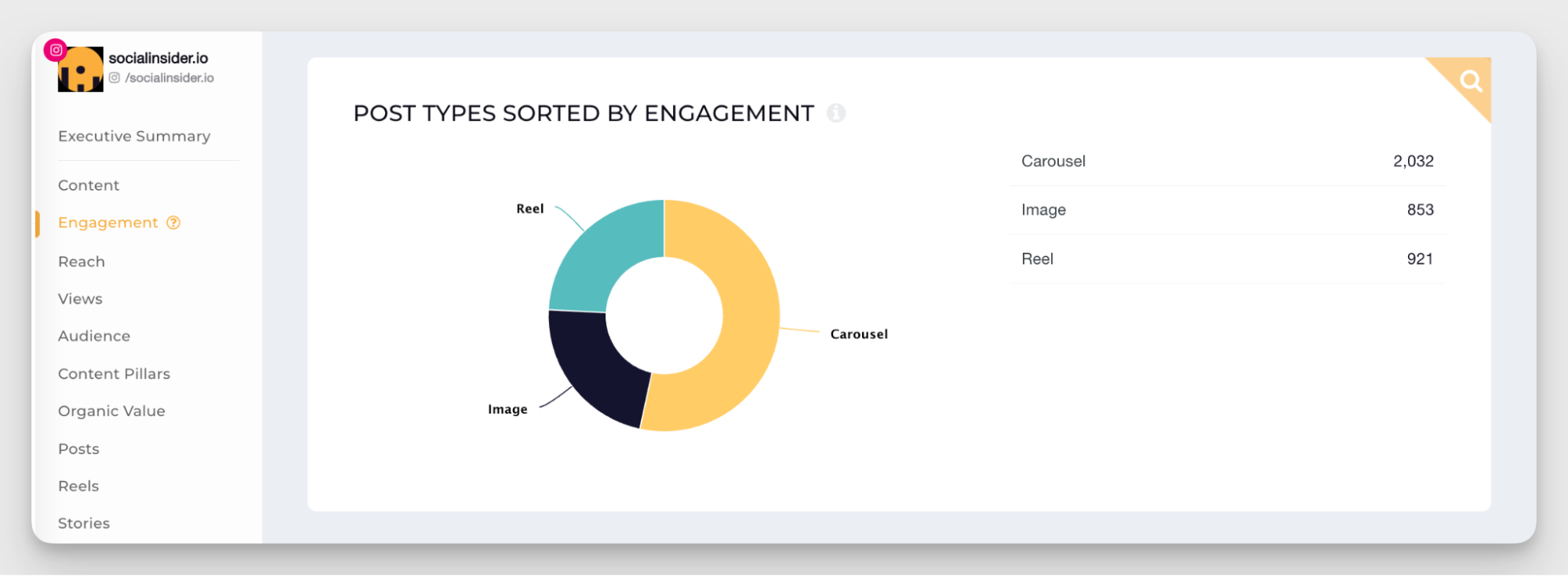

- Content type preferences. Do people respond better to videos, images, carousels, or Stories? This helps me choose the right formats depending on the message I want to deliver.

- Content length, topics, and format nuances. Some audiences love long, insightful infographics, while others prefer a quick, video tutorial. It’s not just the type of content that matters, but how we frame the information.

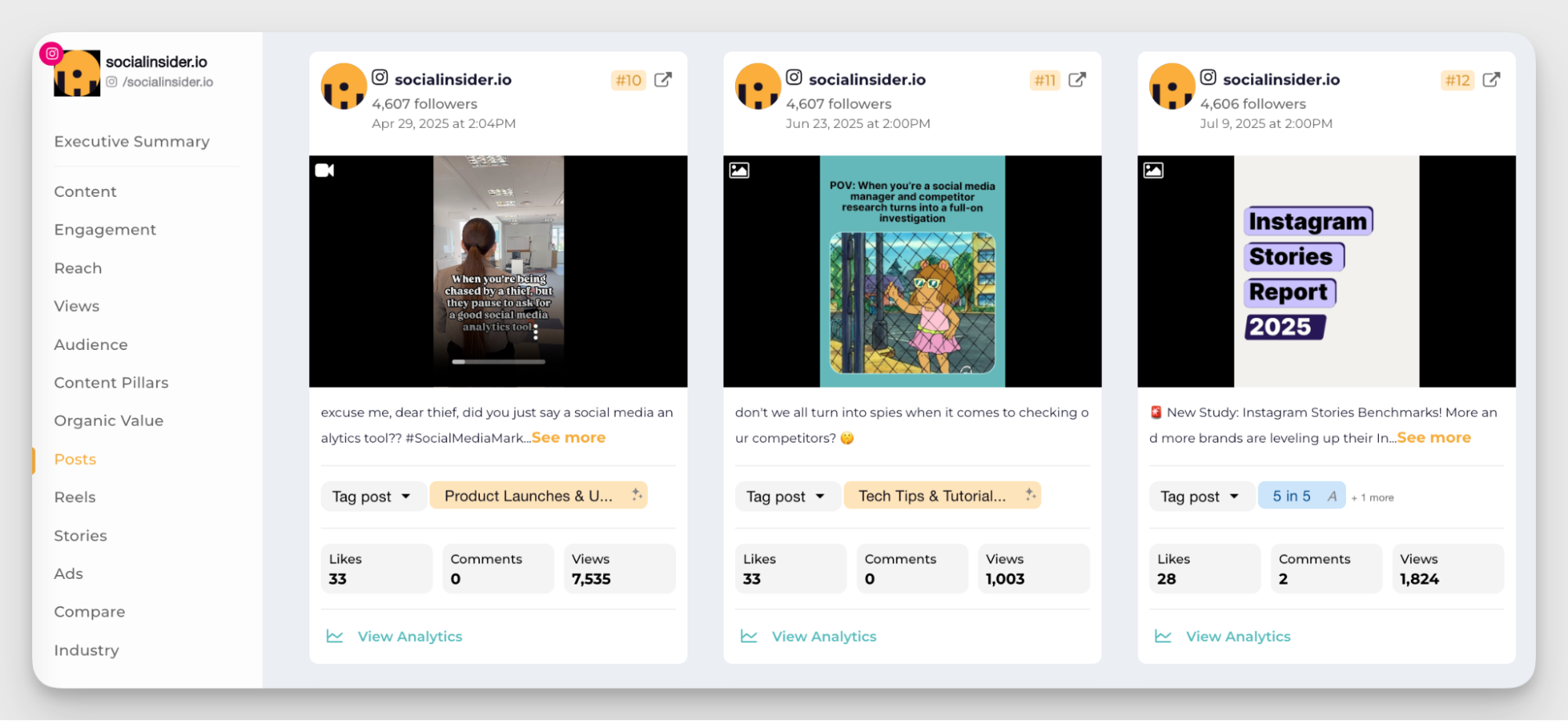

For example, our audience analysis at Socialinsider showed that benchmark- and study-related posts perform consistently well across platforms. Combined with carousels being the top engagement format, it tells us that detailed and nuanced insights are what our audience is after.

Memes are another angle that resonates well. Video format brings in more views, so aiming for a somewhat meme-y video for, say, a product announcement could be a good way to bag more eyes.

Engagement and interaction analysis

Next, I look at how people interact with content over time. This helps me understand motivations, interest peaks, and patterns I can replicate later.

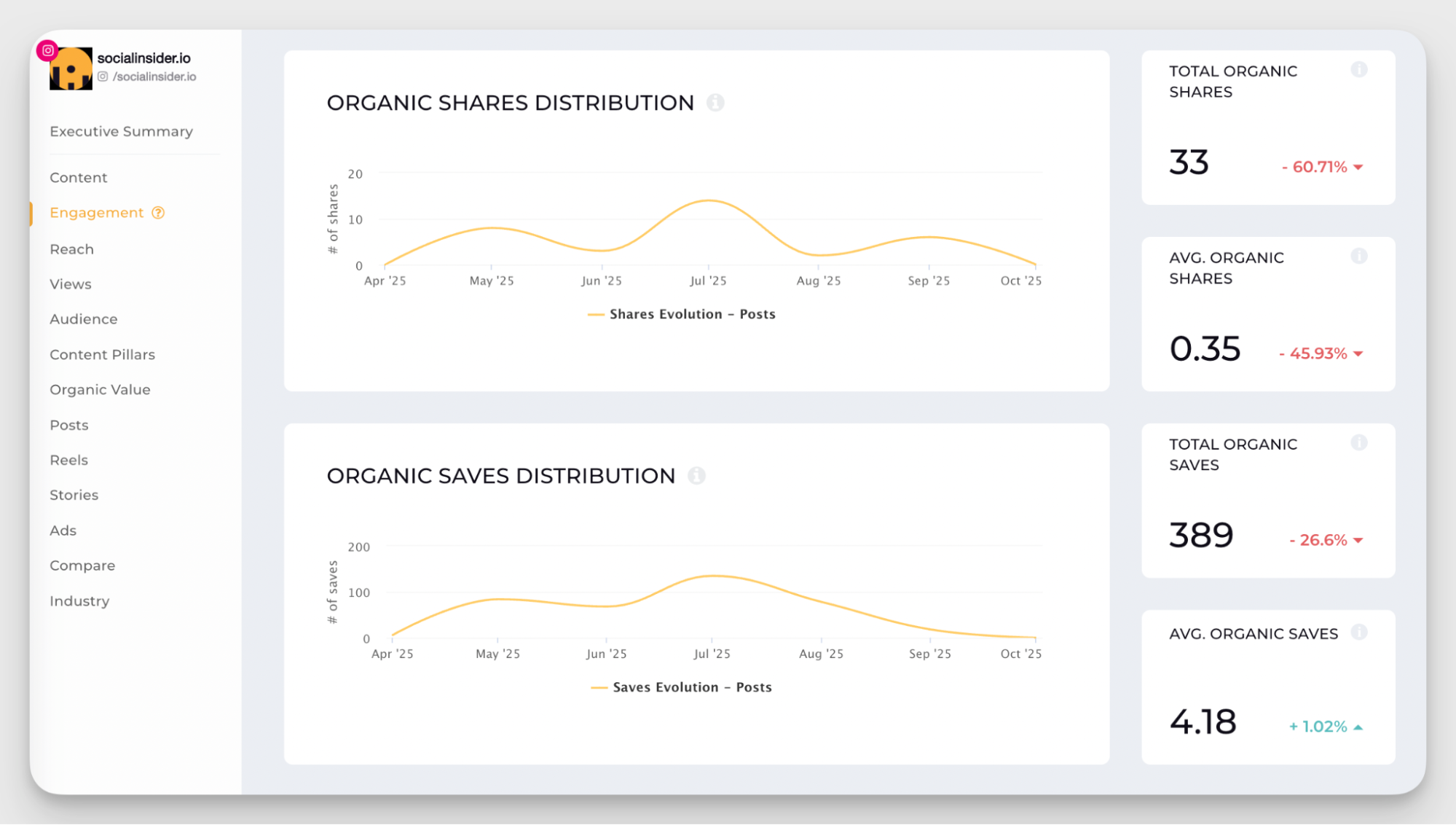

- Analyze engagement peaks and dips. Keep an eye on when engagement suddenly jumps or drops and look for context. Did we test a new format? Join a trend? Launch something? That context helps explain the shift.

For instance, on Socialinsider’s Instagram, July generated noticeably more shares than usual. That means the July content was especially shareable and worth a closer look.

- Track community participation and loyalty indicators. Comments, repeat interactions, and returning engagers say a lot about whether people feel connected to what I’m creating.

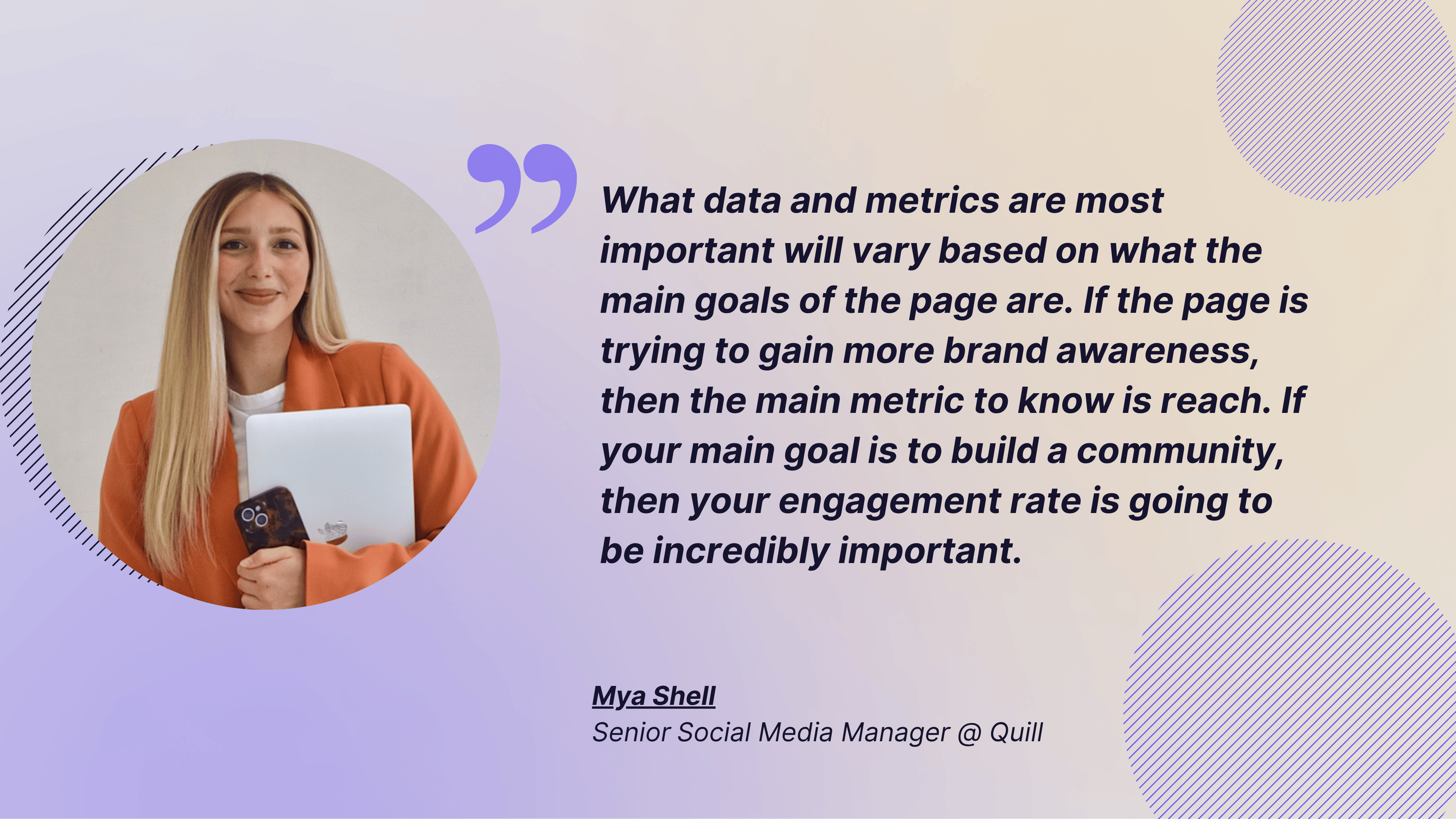

This is also where goal alignment becomes crucial to keep us focused. As Mya Shell, Senior Social Media Manager puts it:

What data and metrics are most important will vary based on what the main goals of the page are. If the page is trying to gain more brand awareness, then the main metric to know is reach. If your main goal is to build a community, then your engagement rate is going to be incredibly important. The metrics to pay attention to need to line up with the main goals.

Step 5: Conduct a competitive audience analysis

of a brand.

In most cases, we share at least part of our audience with the competitors. So taking note of what works (and what doesn’t) for them gives me extra context, especially if I’m working with a smaller brand that doesn’t have tons of data.

But, as Mya Shell explains, competitive monitoring shouldn’t fully run the show:

It’s good to periodically check in and see what your competitors are doing, keeping an eye on the competition but not letting it guide your entire course — then you’ll just end up following behind them and never leading. I document the pieces I find important in a Notion page or Word doc and always take screenshots for proof or reference.

Here’s how I approach competitive audience research:

- Benchmark audience data against industry standards. This is the first filter. I compare growth, engagement, and content output to industry averages to see if I’m on track.

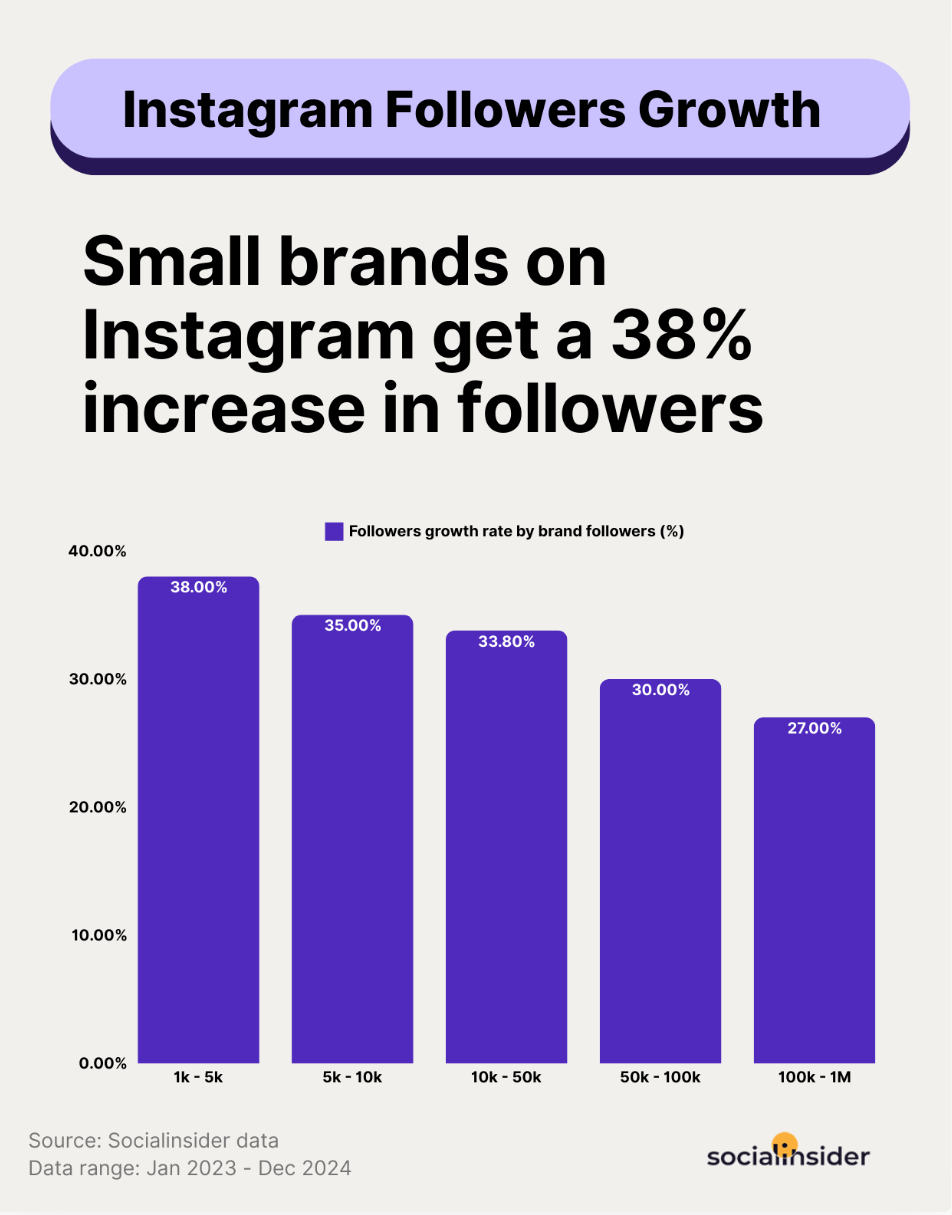

For example, according to Socialinsider’s benchmark study, a smaller brand on Instagram grows around 38% yearly.

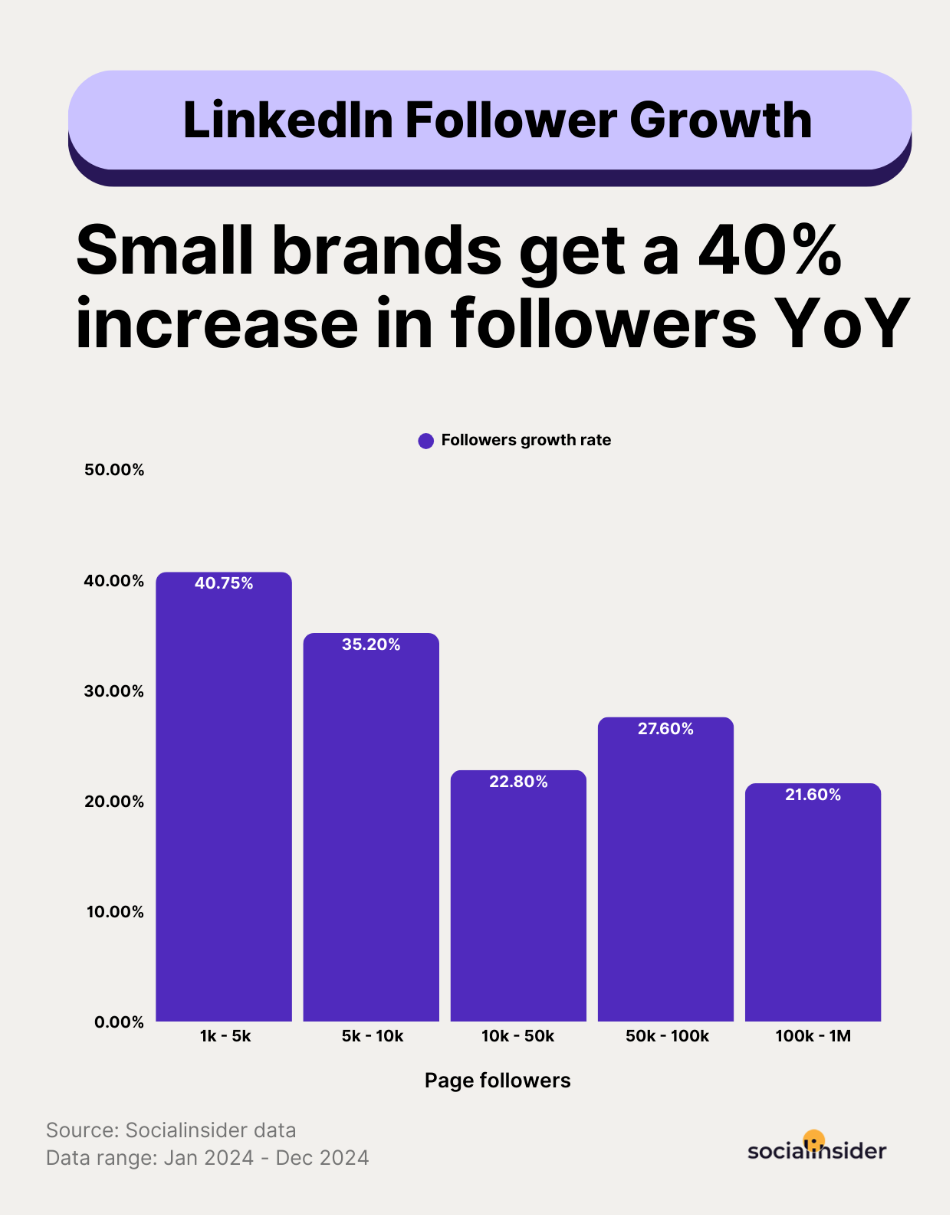

At the same time, LinkedIn sits closer to 40%. If my numbers fall well below these ranges, that’s usually a sign of stagnation.

- Analyze audience overlap between competitors. You share some, not all, of your audience with competitors. I look at their offer, their positioning, and the type of people they attract to understand where we overlap.

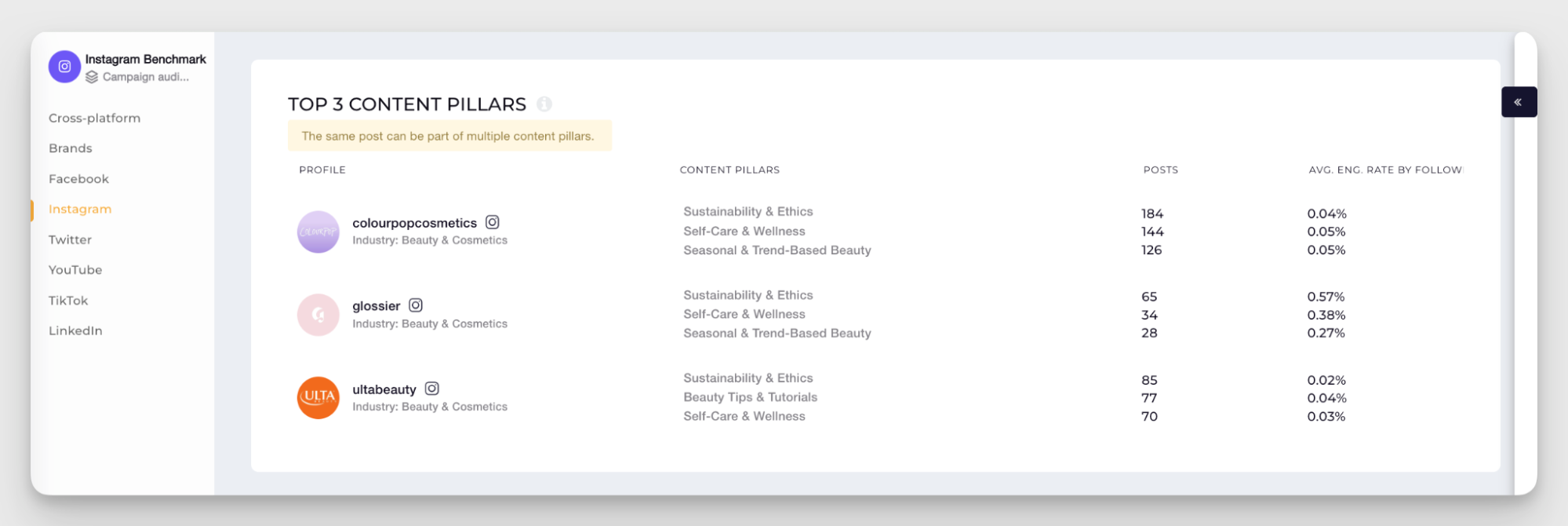

- Look at competitors’ content that resonates with shared audiences. Once I know which segment overlaps, I analyze what topics, formats, or angles perform best for that group.

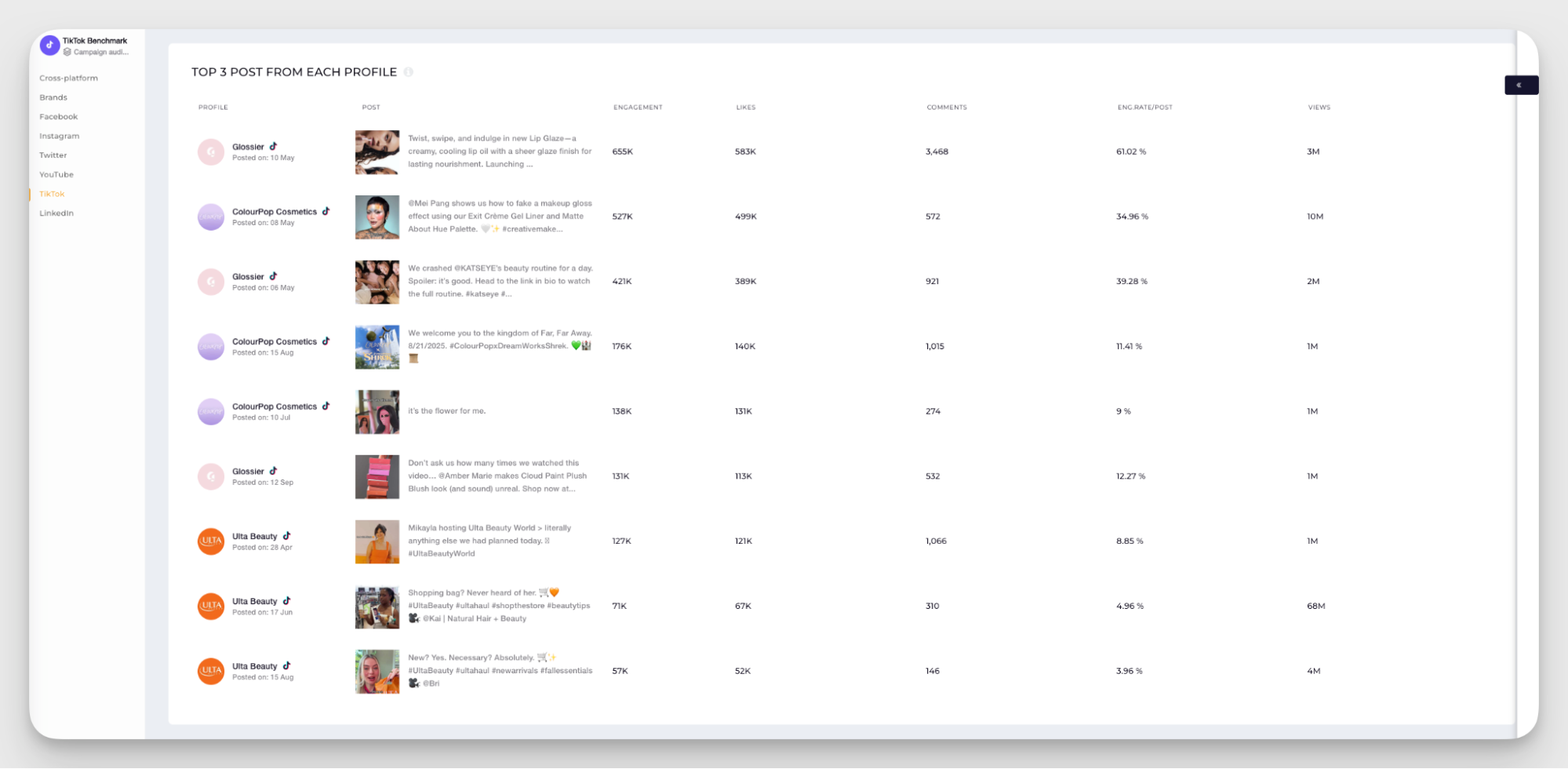

Socialinsider makes this easy by showing 3 top-performing posts for each competitors’ account in one dashboard.

- Discover audience segments your competitors are missing. This is the fun, detective-like part — spotting groups no one is talking to yet. Sometimes it’s a niche interest, sometimes an emerging trend, sometimes a content need your competitors ignore.

- Find audience gaps and untapped opportunities. These gaps often reveal your next content pillar, potentially new crowd, or sometimes a completely new direction you didn’t think of.

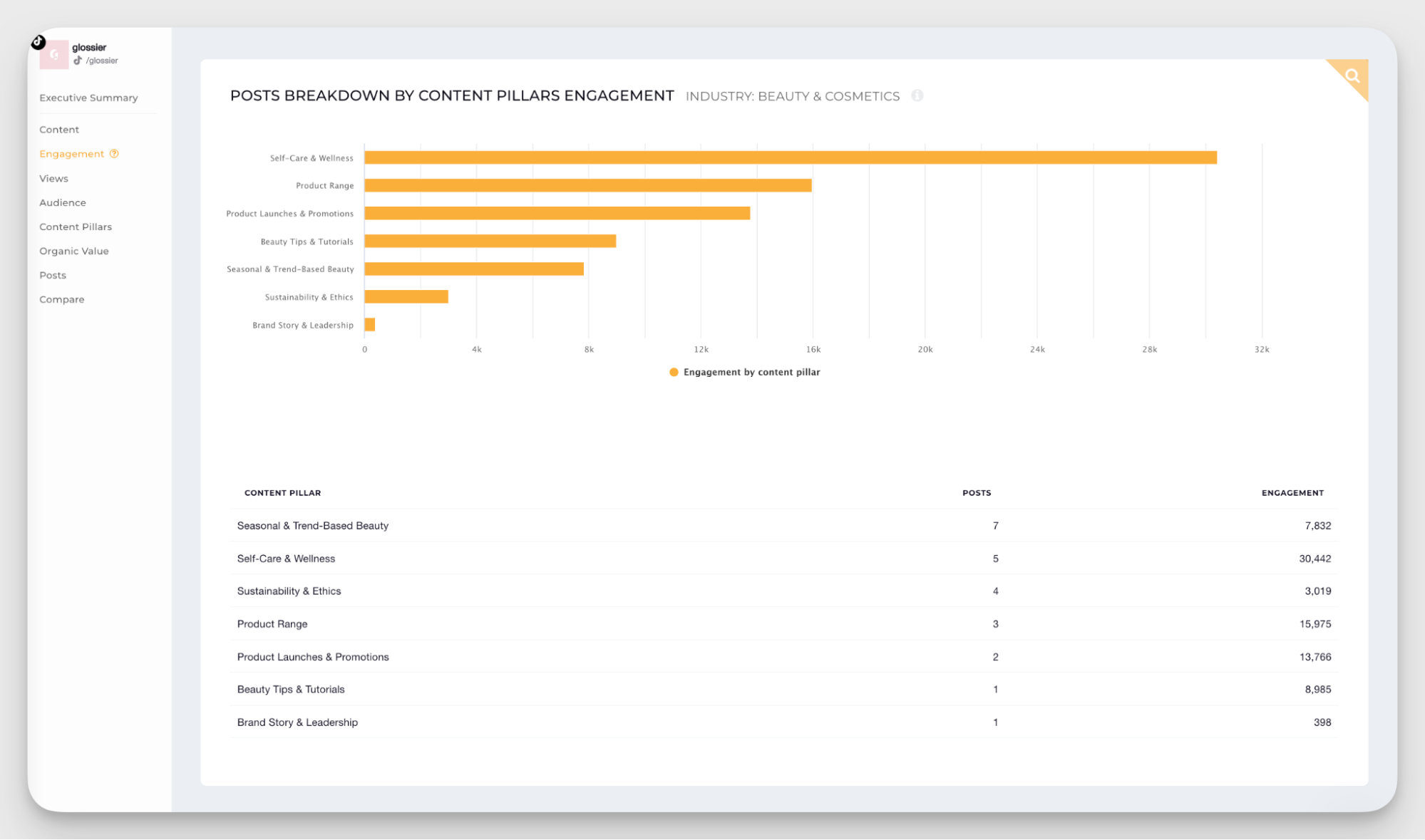

For example, on TikTok, Socialinsider’s data shows that Glossier taps into a “Seasonal & Trend-Based Beauty” pillar that two of its main competitors miss, even though it has huge engagement potential.

The biggest trap of this step is trying to copy your competitors rather than interpreting their signals. Use the competitors insights to better understand your shared audience and see where you can lead.

Step 6: Segment your audience for a targeted strategy

You content strategy gets sharper when you segment your audience channel-by-channel.

Every platform has its own culture, its own formats, and its own “default” way people consume content.

That’s why I never treat “my audience” as one big pool. Even if the same person follows me on TikTok and LinkedIn, they don’t expect the same type of content in both places.

If my general audience is “social media managers,” segmentation becomes much more useful and actionable when I tie it to platforms:

- Instagram: visual-first SMMs (both B2B and B2C) who want benchmarks, quick insights, templates, and digestible info

- TikTok: trend-driven, often B2C-heavy marketers who look for ideas, memes, real examples, and engagement tricks

- LinkedIn: senior marketers, strategists, and team leads who prefer long-form posts, industry analysis, and practical frameworks

- X (Twitter): fast-paced, opinionated marketers who follow real-time updates, commentary, and sharp takes

This kind of mapping helps me tailor content and engagement tactics without reinventing my whole strategy.

Step 7: Step up your audience analysis with advanced techniques

By this moment, the core of social media analysis is done. However, we always aim higher — so I like to add a little extra to make the analysis more actionable and set up for growth.

Here’s what you can do to advance your social media audience analysis and be on the proactive side:

- Identify emerging audience trends before competitors. I watch for early signals: shifts in engagement, new keywords in comments, rising topics in social listening, or formats gaining traction. These small changes usually show up before a trend becomes mainstream, giving me a chance to test ideas early instead of playing catch-up.

- Look for advocacy opportunities and potential detractors. I keep an eye on who consistently supports the brand and participates in conversations. These people usually become advocates with just a bit of extra attention. On the flip side, I also look for recurring complaints or negative sentiment patterns to adjust messaging or fix issues before they snowball.

Essential tools for a successful social media audience analysis

Tools keep your analysis consistent. They automate data collection, help you catch patterns you’d otherwise miss, and make sure your insights stay reliable over time.

Here’s what I include in my stack to run a social media audience analysis that feels clean, complete, and easy to maintain:

Native platform analytics tools

Built-in analytics are often underestimated. However, they’re the most accurate source for understanding your own audience. They offer detailed demographics and platform-specific insights you might not find in other tools due to API access limitations.

Mya Shell praises native analytic tools for offering something extra data-wise:

In-app analytics are my main go-to to understand my audience on each platform. TikTok and Instagram have pretty good insights into your current audience. TikTok will even highlight other content your audience is watching to help you see what other pieces resonate with them.

But there’s always a downside. Native analytics tools usually can’t really analyze competitors, and some platforms limit how far back you can go with historical data.

Third-party analytics platforms

Third-party analytic tools fill in the gaps where native analytics fall short. They give you longer time frames, richer insights, and proper competitive research.

Socialinsider, for example, helps you analyze top-performing content pillars, compare engagement patterns across competitors, study audience demographics, and track behavioral trends over time.

This comes in extra handy for psychographic analysis and digging into the interests and behavioral patterns of your audience.

I use Socialinsider specifically for deeper performance insights, especially when I want to see what works across an entire niche, not just a single profile.

Audience research and survey tools

When it comes to understanding my audience on a deeper level, I don’t just settle for platform analytics.

Here’s how I expand my research for a holistic view:

Social listening platforms

Social listening tools help me understand the conversations happening around my brand and industry. They show what topics people care about, how they talk about them, and the tone they use.

The beauty of social listening is that you get to listen to the conversations you’re not originally part of. It’s one of the fastest ways to spot trends, pain points, and early shifts in sentiment. It also helps in finding opportunities, be it a potential collaboration, brand advocacy, or just a very good meme to jump on.

Survey and feedback collection tools

Never underestimate the power of just asking people what they want or feel!

Polls, quick surveys, and short question boxes give me raw, honest input about what my audience wants or doesn’t want. It doesn’t necessarily have to be dedicated survey tools — sometimes, I use Instagram Stories with interactive stickers, and that’s enough to get the baseline.

These answers add context to the hard data and numbers. They explain why certain patterns show up in my analytics and help me refine decisions with more confidence.

Community monitoring and engagement tools

Engagement doesn’t stop after a post goes live. Community monitoring tools help me keep track of ongoing conversations in comments, groups, or DMs and participate in them.

When talking about analyzing your community, Mya highlights:

During the deep dive into the community, it’s important to feel like you’re becoming a part of the community. You want to think and feel like them, understand them, and their pain points. This not only will help you create better content for this community, but it will help you evaluate what is important to focus on as you do your audit.

Community monitoring tools show me what builds loyalty, what frustrates people, and what subgroups are forming within the audience.

It’s like checking the pulse of the audience in real-time. It helps stay connected and adjust strategy as the community evolves.

How to turn the insights of your social media audience analysis into an actionable strategy?

I always say data is only as useful as what you do with it.

Mya Shell says that interpreting your data is like solving a blind puzzle:

I like to think of pulling data as a blind puzzle — you don’t know what the final picture is, but you start feeling out the pieces and seeing what fits. Once you group the pieces that belong together, a clear image starts to form.

The key is working through each piece without forcing your own bias onto it (which is VERY easy to do).

Once I’ve gathered my audience insights and interpreted them unbiased, it’s time for the grand finale — turning findings into a strategy I can use.

Create content strategies based on audience data

The best content plans are built around what the audience cares about, not what I think they care about.

Gut feeling and experimenting are fine to a point, but assuming I am my target audience is a trap. Instead of vibe-posting, I use real data to guide content choices, which naturally transforms into more engagement.

Using demographic, psychographic, and behavioral insights, I rework my content strategy to:

- Pick the right topics and formats. Short videos, carousels, Stories — whatever floats my audience’s boat, even if it doesn’t fit the overall best practices

- Post at times that match audience habits. While “perfect timing” is overrated, it still helps to show up when people are online and active

- Tap into interests, conversations, and themes my audience already engages with. Why reinvent the bicycle if there are already things my followers are digging?

Develop platform-specific audience engagement tactics

Every platform attracts a slightly different crowd, and their behavior shifts with it.

With segmented data in hand, I adjust my approach instead of copying and pasting the same tactic everywhere:

- On Instagram, I lean into visual trends, short-form content, and quick interactions like polls or emoji sliders

- On LinkedIn, I focus on industry insights, practical advice, and building a conversation people want to join, as well as proactively joining the conversations of others

- On TikTok, I keep it real with quick, authentic videos that usually outperform anything that feels overly polished

Matching the tactics to platforms allows me to deliver my message without disrupting the way people naturally use each channel. Brand content doesn’t stick out like a sore thumb but rather joins the stream.

Build a community based on audience needs and interests

Once I understand what my audience wants, I can start building a space that feels welcoming and worth coming back to. It can look like:

- Creating regular touchpoints for interaction — Q&As, AMAs, prompts, or simple check-ins

- Highlighting user-generated content or sharing follower stories to build a connection

- Supporting small subgroups or niche interests that naturally form around the brand

When people see that as a brand, we’re paying attention instead of just broadcasting, they get more involved. That’s how followers turn into contributors, and eventually into loyal advocates.

Final thoughts

Mastering social media audience analysis is an ongoing journey, not a one-time task. By looking past vanity metrics and diving deep into real needs, behaviors, and motivations, you'll be able to create content that truly resonates and drives results.

Equipped with the right tools, clear objectives, and a willingness to keep learning, you can stay ahead of trends and continuously connect with your community on a meaningful level. Remember, real insights always lead to better strategy—so keep listening, keep analyzing, and let your audience guide the way.

FAQs on social media audience analysis

Why do you need to establish clear goals for your audience analysis?

- It keeps your efforts focused: Without clear goals and social media KPIs, you might gather a lot of data without knowing what to do with it. Goals help you zero in on the specific information you actually need.

- It defines success: Clear goals allow you to measure whether your analysis is effective. For example, if your goal is to understand why engagement dropped, you’ll know you’re successful when you find actionable reasons and solutions.

- It saves time and resources: Audience data is vast. Goals prevent you from wasting time analyzing irrelevant social media metrics that don't support your current business needs.

- It ensures actionable outcomes: If you know why you’re analyzing your audience, the insights you gather are more likely to lead to strategic changes, like adjusting content types, posting times, messaging, or even targeting new customer segments.

What are the common audience analysis mistakes to avoid?

- Ignoring qualitative data and direct feedback. Dashboards are great, but some of my best insights come from comments, DMs, surveys, and real conversations. If I skip these “softer” signals, I miss the motivations and frustrations that numbers alone can’t explain.

- Overlooking cross-platform behavior. Your audience doesn’t live on one channel. If I only study Instagram, I might miss key patterns happening on TikTok, LinkedIn, or X. Mapping how people behave across platforms gives me the full picture instead of a narrow slice.

What are some best practices for maintaining ongoing audience intelligence?

- Track audience evolution and trend shifts. Audience analysis isn’t a one-time audit. I check in regularly to spot new interests, shifts in demographics, or changes in engagement patterns. This helps me stay ahead and adjust my strategy before anything feels outdated.

- Build an audience-first workflow. I bring audience insights into every part of my process, from brainstorming content to refining targeting. I routinely ask, “What does my audience need right now?” Keeping that question front and center makes every decision more grounded and intentional.

Kseniia Volodina

Content marketer with a background in journalism; digital nomad, and tech geek. In love with blogs, storytelling, strategies, and old-school Instagram. If it can be written, I probably wrote it.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.